Fintech startups in Indonesia have initiated a revolution the way financial institutions including banks in the country work. The fintech landscape of Indonesia has more or less followed the trajectory of the revolution India witnessed last year.

Fintech startups in Indonesia have initiated a revolution the way financial institutions including banks in the country work. The fintech landscape of Indonesia has more or less followed the trajectory of the revolution India witnessed last year.

India, November 2016. PM Modi launched a demonetisation drive to eradicate black money, fostering a new wave of digitisation in India. Consequently, there was a tremendous rise in the adoption of e-wallets, launch of new fintech startups, and the average Indian became familiar with a new financial entity, bitcoin. With huge sums being invested in the segment, Fintech became the frontrunner of the Indian startup ecosystem.

From local grocery shops to petrol pumps to movie theatres, digital wallets have captured each and every day-to-day business which requires payments. Not only this, digital wallets have even seen a massive adoption for payment chores like booking air tickets or buying movie tickets or paying bills (DTH, Water, Electricity). In a nutshell, India is poised towards fintech revolution – thanks to the rise of digital wallets, UPI coming into the picture and of course, companies launching payment banks.

Coming to Indonesia, there are more than 150 fintech startups in Indonesia and this number has increased by a whopping 78% from 2015, according to the Indonesia Fintech report 2016. Quite similar to the India story, not in context to numbers but the growth percentage. India recorded $1.77 Bn in FinTech investments between 2014 and 2015 through a total of 158 deals, according to Inc42’s FinTech Market Report 2014-2016. The average deal size was $9.82 Mn.

All of this has happened in the last couple years. So when we ask ourselves how? The answer is simple: when technology meets innovation, disruption happens.

The Present Indonesian Financial Ecosystem

With a population of more than 250 Mn and a consistent growth in the annual gross domestic product (GDP), Indonesia has emerged as Southeast Asia’s trojan horse, as the next big land of opportunity.

Fintech today is a coveted space in Indonesia. Investments are booming, sectors are expanding, various avenues are being explored and new products are being launched. Be it digital payments, online lending, or remote banking, Indonesia has seen a surge of startups that have developed products to solve the current needs of the population.

At the same time, the country remains a challenging market for fintech industry to grow with only 40% of adults in the country having access to banks. 49 Mn SMEs unit are still not bankable, because of low credit score and little or no financial history. So how does one understand this industry?

Why Indonesia Needs Fintech

Businesses are essentially established to solve consumers’ needs. Fintech in Indonesia has followed the same pattern. To begin with, a vast majority of the Indonesian population is doesn’t have access to banks. It is estimated that only 40% of Indonesia’s 250 Mn population currently have access to services provided by banks. This impressed the need to develop alternative banking systems that could provide users with new and effective ways of banking.

Adds Kaustav Ghosh, Product Evangelist, MatchMove, “Like other similar markets, Indonesia has historically been relatively low on banking penetration. At the same time, it has seen a vibrant prepaid airtime and utility payments culture, a robust prepaid cards business base and a very creative entrepreneur class. Banks themselves have proven that they are innovative. While it may be little appreciated elsewhere, Indonesia has a very large informal economy and the many small businesses drive a lot of demand for services and new concepts. It has helped that the regulator has been progressive and abreast of global developments. Indonesia also has strong domestic brands emerging out of a native start-up culture. All this has been fertile ground for fintech.”

Secondly, Indonesia is a country of SMBs. These enterprises account for 99% of the total amount of enterprises that are operating in Indonesia and they create a total of 107.6 Mn jobs in Southeast Asia’s largest emerging economy, as per a Deloitte report. Moreover, Indonesia’s micro, small, and medium-sized companies contribute 60.6 % to Indonesia’s gross domestic product (GDP). In fact, they cushion the country’s economy in times of shocks. However, the majority of these companies do not pay taxes, while most workers belong to the informal sector.

Says Piotr Jakubowski, CMO of Indonesian ride-hailing giant Go-Jek, “One of the most fascinating challenges in Indonesia which contributes to the large population not having access to banks (60%+) is due to the fact that the country is the world’s largest archipelago. The size and the nature of the country simply does not allow traditional financial systems to scale and cover everything. For example, one of the state banks in Indonesia has actually transformed small boats into branches that can reach consumers in even the most remote areas. By breaking down the barriers of location, the emerging players provide an opportunity to this large population which doesn’t has access to banks to join the digital economy and drive its growth.” (bq)

In order to accelerate their growth, the SMEs need funding, yet many of them do not have the necessary financial history nor collateral to secure loans from banks. The sector is still largely unorganised, thereby struggling to maintain even basic workflow requirements, in terms of capital access. Lack of credit history, collateral, and accounting discipline, further mars these small-time businessmen’s capacity to procure funds from sources other than shady money lenders and friends and family – giving rise to the need and a largely untapped market for alternative lending and credit platforms.

Thirdly, due to Indonesia’s peculiar geography, its traditional banking system suffers. The number of bank branches, which is estimated at 10 banks (branches) per 1,000 square kilometers is far too low to serve Indonesia’s vast geography. The fact that there are remote and inaccessible areas in the country poses an even greater challenge for banks’ penetration, which gives birth to the need of online and remotely accessible institutions that can facilitate these financial needs.

Breaking Down The Indonesian Fintech Pie

Bank of Indonesia defines fintech as: “A phenomenon of fusion between technology and financial features that transform business models and a weak barrier to entry which lead to raises unregulated players to run the service as well as regulated financial institutions.”

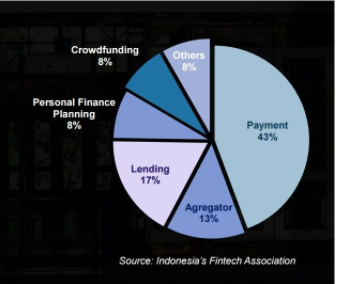

As highlighted above, the country has seen a major surge in the number of fintech ventures. The major areas that startups are capturing and disrupting are payments, insurance, stock markets, investments, PoS, comparison, and online lending. The clear winner is digital payments, prompted by the fact that the internet and consumption patterns are changing. Major startups in the payments sector include Mandiri, T-Cash, PayPro, IPayMu, Xenditi among others.

Digital payments have become so big in the archipelago that the total transaction value in the “Digital Payments” segment amounts to $18 Mn in 2017. Additionally, the total transaction value is expected to show an annual growth rate (CAGR 2017-2021) of 18.4 %, resulting in the total amount of $36 Mn in 2021. Popular fintech categories in Indonesia are lending platforms, capturing 17% and marketplaces for financial products that have occupied 13%.

Says Sebastian Togelang, founding partner, Kejora Ventures, “Fintech is the hottest space in Indonesia right now. Everyone, be it founders and VCs are running towards capturing the opportunity. We might also see a lot of funding and consolidation in the space, in the coming times.”

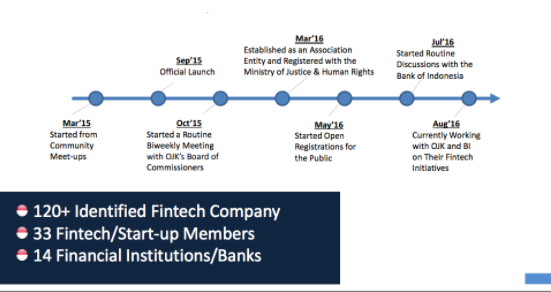

When it comes to its potential as a market for Internet-based services, the numbers seem to bear great promises for Indonesian market. Internet users in the country had exceeded 100 Mn, with over 326 Mn mobile subscriptions — or roughly 34% of its total population. The emergence of new players led to the establishment of Indonesia Fintech Association in September 2015.

A report by Daily Social and Fintech Indonesia says that Indonesia has entered the Fintech 3.0 stage, where innovation is championed by startups instead of financial institutions as in Fintech 2.0 stage, or a joint venture of financial institutions and tech companies in Fintech 2.5.

The digital payments sector has emerged as the clear winner since the IFA data shows that around 43% of startups of the fintech pie belong to that segment. They are majorly spread across payments sector, from mobile payment to payment gateway companies etc. Suffice to say, ecommerce has been the biggest push factor for the same because, with the shifting consumption patterns, it led to the growth of payment avenues where one could complete their financial transactions with the ease of a click. For people to shop online, you have to make it really easy for them to pay.

Echoing the same, Chiragh Kirpalani, founder of digital payments platform Ayopop which recently secured funding says “Digital payments currently is still under the closed-loop model. Where each startup has either their own internal wallet or store credits and can only be used with-in their own services offered. The market is starting to evolve and startups are in merchant acquisition mode at this point. From what I see, the first few sectors that will start to have “Pay Via XYZ Wallet / Brand” is going to be online ecommerce, followed by the F&B sector and then comes Entertainment (theme parks, cinema Chains, Karaoke Chains, etc).”

Payment also has many subcategories. -whether it is making it easier to pay for online goods with cash; to focussing on the cards people already have in their pockets. There are certain players that are working towards linking existing transaction terminals like ATMs or online banking with online shopping, while others want to convince users to store value in digital wallets.

Fintech Startups That Are Paving The Way

While the Indonesian fintech industry has seen the entry of various players, here’s a consolidated view of the ones that have led the way with their disruptive technologies:

Deposits, Lending, And Capital Raising

Startups under this category allow users to obtain loans or funds for numerous purposes such as for business, social project and marriage. Both crowdfunding and peer-to-peer lending technologies fall into this category. The online lending space is dominated by players included Modalku, Taralite, and Investree. The online lending segment has a huge market demand in the country, owing to the fact that a major population of the country has a low credit score and SMEs can benefit from these alternative services.

Taralite: Launched in 2016, the startup sanctions financial loans with relatively low interest, starting from 1%, for education, marriage, childbirth, house renovation, vehicle purchase, property & housing. It also provides loans without collateral. It recently secured $6.3 Mn from Japanese financial services provider, SBI Group.

Taralite: Launched in 2016, the startup sanctions financial loans with relatively low interest, starting from 1%, for education, marriage, childbirth, house renovation, vehicle purchase, property & housing. It also provides loans without collateral. It recently secured $6.3 Mn from Japanese financial services provider, SBI Group.

MODALKU: Founded in 2016, it is an online lending platform, that provides loans up to IDR. 2 Bn, with relatively affordable interest. Its focus areas are SMEs looking for working capital, with minimum one year of operations. It raised $7.5 Mn in its Series A round of funding from Sequoia in August 2016.

MODALKU: Founded in 2016, it is an online lending platform, that provides loans up to IDR. 2 Bn, with relatively affordable interest. Its focus areas are SMEs looking for working capital, with minimum one year of operations. It raised $7.5 Mn in its Series A round of funding from Sequoia in August 2016.

Investree: Launched in 2015, Investree has a peer-to-peer (P2P) lending platform that connects people who want to invest money with people who want to borrow money. Investree administers the lending process by verifying borrower’s creditworthiness, facilitating the fund between borrower and investors, and documenting legal loan agreement. In June, it secured the commitment of a Series A round of funding from Kejora Ventures.

Investree: Launched in 2015, Investree has a peer-to-peer (P2P) lending platform that connects people who want to invest money with people who want to borrow money. Investree administers the lending process by verifying borrower’s creditworthiness, facilitating the fund between borrower and investors, and documenting legal loan agreement. In June, it secured the commitment of a Series A round of funding from Kejora Ventures.

Kitabisa.com: A social crowdfunding platform where, individuals can use it to initiate campaigns and donations, as well as view and choose the campaigns to which they can donate.

Kitabisa.com: A social crowdfunding platform where, individuals can use it to initiate campaigns and donations, as well as view and choose the campaigns to which they can donate.

Market Provisioning

Under this category, startups function as resource books to anyone entering a potential fintech market. They provide users with relevant data, assistance, and guidance regarding various markets.

Cekaja.com: Launched in 2013, the platform allows users to compare various financial products at one place. The products include but are not limited to vehicle and health insurances, credit cards, housing loans, Internet and cable TV packages, and SME loans. It secured Series B funding in October 2016.

Cekaja.com: Launched in 2013, the platform allows users to compare various financial products at one place. The products include but are not limited to vehicle and health insurances, credit cards, housing loans, Internet and cable TV packages, and SME loans. It secured Series B funding in October 2016.

TaniHub: Tanihub is an ecommerce platform that connects farmers and buyers and eliminates the need for middlemen.

TaniHub: Tanihub is an ecommerce platform that connects farmers and buyers and eliminates the need for middlemen.

Investment & Risk Management

Startups functioning in the automated processing, dissemination of investment, and risk management advice for individuals and companies fall under this particular sub-category.

![]() JOJONOMIC: JOJONOMIC digitises the entire employee reimbursement process for an employee. Launched in 2015, the startup offers an application-based reimbursement system to minimise the company’s miscalculation risk and accelerates the reimbursement processes. It raised $1.5 Mn in its Series A round, in September 2016.

JOJONOMIC: JOJONOMIC digitises the entire employee reimbursement process for an employee. Launched in 2015, the startup offers an application-based reimbursement system to minimise the company’s miscalculation risk and accelerates the reimbursement processes. It raised $1.5 Mn in its Series A round, in September 2016.

RajaPremi: Founded in 2014, RajaPremi is an online insurance marketplace. It enables users to select various insurance programmes, compare them at a single place, and finally purchase the most suitable insurance. It secured undisclosed funding in 2015.

RajaPremi: Founded in 2014, RajaPremi is an online insurance marketplace. It enables users to select various insurance programmes, compare them at a single place, and finally purchase the most suitable insurance. It secured undisclosed funding in 2015.

Bareksa: Founded in 2016, it is an online and integrated marketplace for mutual funds. It makes investing in mutual funds easier, by providing the necessary options, tutorials, and tools for mutual funds investments. The startup secured undisclosed amount in funding in April this year.

Bareksa: Founded in 2016, it is an online and integrated marketplace for mutual funds. It makes investing in mutual funds easier, by providing the necessary options, tutorials, and tools for mutual funds investments. The startup secured undisclosed amount in funding in April this year.

Digital Payments

This category introduces customers to novel ways of both online and offline payments, and other related opportunities in regards to payments.

Kudo: Launched in 2014, the startup has a website and a mobile application that enables anyone to be an online entrepreneur without having to personally stock the items. Verified sellers or ‘agents’ are free to choose from roughly three million types of products to be sold. Buyers will pick their products, contact the respective agents and agree on the payment method. It was acquired by ride sharing platform Grab in February this year.

DOKU: A 2007 founded startup, Doku is the biggest player in the Indonesian payments scene. Functioning as an online and offline payment gateway for businesses and individuals, DOKU is an e-wallet equipped with links to credit card and electronic money. It functions like Paytm and users can also be used to send money to offline retailers registered on the network.

t-cash: Founded in 2011, it is an electronic money service provided by Telkomsel (a telecom giant). Users are required to install the T-Wallet app on their mobiles and equip their mobiles with the t-cash stickers. The stickers are to be scanned at merchants with t-cash scanning machines upon payment. Other forms of payments such as utility bills, train tickets, and concert tickets can also be done using the app.

t-cash: Founded in 2011, it is an electronic money service provided by Telkomsel (a telecom giant). Users are required to install the T-Wallet app on their mobiles and equip their mobiles with the t-cash stickers. The stickers are to be scanned at merchants with t-cash scanning machines upon payment. Other forms of payments such as utility bills, train tickets, and concert tickets can also be done using the app.

Ayopop: Launched in 2016, Ayopop is an app that specialises in bill payments. In other words, it enables users to pay for things like their phone bills, electricity, and Internet services through its app. The startup secured funding earlier this year from GREE Ventures.

Ayopop: Launched in 2016, Ayopop is an app that specialises in bill payments. In other words, it enables users to pay for things like their phone bills, electricity, and Internet services through its app. The startup secured funding earlier this year from GREE Ventures.

POS (Point-Of-Sales Startups)

Pawoon: Launched in 2013, Pawoon is a cloud-based Point of Sales (POS) application for SMEs. It helps them become more efficient and productive in running their business, by providing a platform that gives them the tools to thrive in the current era of connected commerce. It closed its Series A round earlier this year.

Pawoon: Launched in 2013, Pawoon is a cloud-based Point of Sales (POS) application for SMEs. It helps them become more efficient and productive in running their business, by providing a platform that gives them the tools to thrive in the current era of connected commerce. It closed its Series A round earlier this year.

DealPOS: DealPOS is a cloud-based point-of-sale ( POS ), inventory and accounting software for business which was also launched in 2013. DealPOS was founded to provide small businesses with an easy-to-use software to help manage their inventory and billing activities.

DealPOS: DealPOS is a cloud-based point-of-sale ( POS ), inventory and accounting software for business which was also launched in 2013. DealPOS was founded to provide small businesses with an easy-to-use software to help manage their inventory and billing activities.

Cryptocurrencies

Says Hari Sivan, founder and CEO, SoCash, “Cryptocurrencies are far away from mass adoption for value exchange, the incremental benefits over other payment options are overrated. Cross-selling is something all business eventually do, so perhaps a data driven approach may give some businesses are the chance to disintermediate others. In a large & diverse market with growing demographics, the “next big thing” is hard to predict. However, it will be safe to bet on software-led innovation, shift towards renewables in our energy mix and automation forcing a massive need to re-skill the workforce in the next two decades.”

Quoine: Quoine is an advanced Bitcoin trading platform offering margin trading and algo-trading across a number of currency pairs which was launched in 2014. It secured $20 Mn in its latest funding round in June 2016.

Quoine: Quoine is an advanced Bitcoin trading platform offering margin trading and algo-trading across a number of currency pairs which was launched in 2014. It secured $20 Mn in its latest funding round in June 2016.

Bitcoin.co.id: Launched in 2013, it is the biggest Indonesian Bitcoin Exchange that acts as the backbone for the entire finance ecosystem in Indonesia implementing cryptocurrency technology in the payments system and remittance business. The startup secured $50K in an angel round of funding in February 2014.

Bitcoin.co.id: Launched in 2013, it is the biggest Indonesian Bitcoin Exchange that acts as the backbone for the entire finance ecosystem in Indonesia implementing cryptocurrency technology in the payments system and remittance business. The startup secured $50K in an angel round of funding in February 2014.

In 2016 alone, the total disclosed funding in fintech in Indonesia reached $36 Mn (IDR 486 Bn), which includes IPOs and investment from parent company outside of the country. With eight investment activities in 2016, East Ventures came out to be the most active local venture capital which poured funds into fintech startups in the country. On the other hand, 500 Startups took the title of the most active foreign VC in Indonesia’s fintech ecosystem, with 3 investments in 2016.

Banks, Fintech, & Startups: The Holy Trinity

With the advent of startups in the last few years, the banks have seen itself changing from a predominantly transactional business to a customer-centric one. With shifting consumption patterns, it is only a matter of time that the digital natives will conquer traditional players when it comes to customer acquisition, thus changing the industry ecosystem and forcing financial organisations to shape up or ship out. The digital sector is evolving rapidly and encompassing each facet of banks and fintech startups today, need to be on top of their game to stay ahead of the competition.

New-Age financial institutions aka fintech startups, like online lending platform, can offer affordable loans for customers as higher efficiency translates to less operational cost, which can pose a threat to the existence of banks, especially to those that are still reluctant to provide digital services. At the same time, the current penetration rate of fintech services in Indonesia is below 2%, as per a GIV report. This strengthens the position of banks as still the dominant players when it comes to customer retention and the Internet penetration.

Fintech, will thus prove to be a double edged sword for the Indonesian banks. On one hand, the traditional brick-and-mortar banks are being pushed to speed up their games and adopt technology as their primary vehicle for customer retention, just like in India.

For instance, earlier this year, in January 2017, Bank Tabungan Pensiunan Nasional (BTPN) launched its own fintech service, called Jenius, which allows users to open accounts in banks via a mobile device and manage their own personal finances. Users can also give a nickname to their banks account, instead of the conservative lengthy account number. This shows that banks have now become open and receptive to the idea of tech-efficient credit systems and are open to entering into strategic partnerships with various startups for lending and payments.

A successful fintech ecosystem of the future will be where all the market participants connect engage and share ideas across vibrant communities and networks as well as identify and convert opportunities into business. In this age of penetrative technology, no market participant can afford to operate individually.

Government And The Fintech Opportunity

For any new venture to succeed, in a country where the number of potential entrepreneurs is rising by the day, the role of administrative bodies and government towards boosting the emerging tech sector and other financial institutions, becomes very crucial. No technical and industrial sector can grow without adequate support from its administrative bodies.

The government, being receptive of developments in the fintech sector, launched the Fintech Association of Indonesia in 2015. As per an official statement, it has more than 55 registered startups and has identified 120 more.

The country’s President, Joko Widodo, in June 2016 also launched an initiative called the ‘1,000 Startups Movement.’ The initiative aims to develop 1,000 startups by the end of 2020, the total valuation for which is expected to be around $10 Bn. Additionally, it also plans to establish a dedicated section within its main stock exchange to host initial public offerings by startups. It wants to set up a new trading market, that will be called the ‘technology board” – at the Indonesia Stock Exchange with an aim to ease the process for founders and investors to take their companies public in an easier way.

With an aim to provide small business owners with necessary financial assistance, the government of Indonesia has launched PENSA (Program for Eastern Indonesian Small and Medium Enterprise Assistance) in collaboration with the International Finance Center (IFC).

In November 2016, the Indonesian government, through the Central Bank, had launched the Regulation on Payments Transaction Processing to provide legal assurance for new and existing payments business activities. It has also created a Fintech Office whose work also includes capacity building and regulatory sandboximplementation.

In December 2016, the FSA issued a regulation on online peer-to-peer (P2P) lending, only one month after the Bank of Indonesia launched operations of a special office for fintech. As per a report by the Jakarta Post, the government has also implemented digital signatures in the country, and the process will come into being by the second quarter of 2017.

Challenges And The Road Ahead

FinTech can be developed to reach millions of Indonesians by providing easier access to a wide range of financial products tailored to the characteristics of the community. Like financial services in general, fintech is a business of trust, and incidences of frauds would lead people to abandon the tech.

Secondly, providing a solid back-end infrastructure is very important to support venture capitalists. If the exit infrastructure is not available, venture capitalists would then choose to list startups abroad, with better chances of gain from its secondary markets. Therefore, the Indonesia Stock Exchange, OJK, startup founders, and venture capitalists should be sitting together to find best practices for this issue, such as a parallel stock exchange.

The government too needs to come to the front and issue some extensive rules and regulations, when it comes to operating fintech in Indonesia. At the same time, regulations that will be issued by the OJK should not be too rigid, so as to provide a balanced climate. Some regulatory concerns include business licensing, business operation, governance, supervision and inspection, reporting obligations, and equities. Maintaining and promoting enthusiasm for the sector, with a climate of fair opportunities takes absolute essence.

At the same time, secondary factors like education, information, and Internet penetration would also need a boost so as to push the bandwagon of Indonesian fintech startups further. The fintech ecosystem that has roped in banks and startups alike in its waves would go till which great extents, only time will tell.

Categorized in: